Alberta has a market for the supply of wholesale electricity. Prices vary with supply and demand. All other provinces but Ontario have a utility that is responsible for generating as well as delivering electricity and maintaining its infrastructure. In Alberta these tasks are the business of private generators (e.g. TransAlta, Enmax Energy) and wires owners (e.g Altalink, Fortis, Enmax Power), and there is an independent body mandated by Alberta Utilities Commission, called the Alberta Electric System Operator, that manages the grid and price of power. In this blog post we’ll go over how power prices are determined, and how solar and renewables in general affect a deregulated power market.

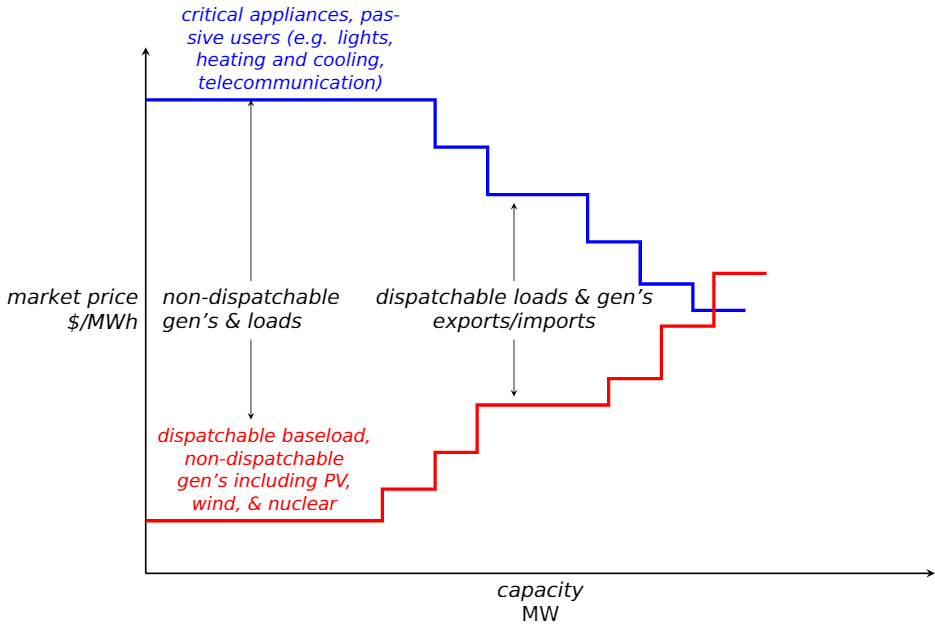

Alberta has an energy-only power market, which means that generators only collect revenue from generating electrical energy. The price of wholesale electricity is determined in real time by a merit order as shown below. Much like with any supply-demand curve, prices (y axis) are put in ascending order alongside respective generator capacity (x axis), and the point to which the supply and demand curves intersect determines the clearing/market price and clearing capacity. This happens every minute ensuring that demand is always met and consumers are getting the lowest cost for electrical energy. Generators on the left of the intersection point will be dispatched because their offering price is less than what the market established. For example a natural gas power plant can put up 30MW for $15/MWh from 3pm to 4pm. If at 2:59pm the price of power happens to be higher then it will be dispatched.

Renewable generators have no fuel costs and therefore can afford to sell power at any rate. If they are generating power they want it to be sold immediately. Therefore they will always be the cheapest generators on the supply curve. On the other hand fossil fired generators such as coal and natural gas have considerable operating costs and will bid their capacity at a rate that’s economically sustainable. Baseload generators will be operating for most of the time and will be found more towards the left and centre of the curve while peaker plants as their name suggests are only dispatched when market prices occasionally spike.

Supply demand curves are not new. The genius of this system however is that it uses price signals to balance a highly sophisticated circuit in real-time. Generation-demand have to always be in balance otherwise power quality will deteriorate or worse cause power outages which are expensive and just unacceptable. Unlike a potato market where you get to meet potato farmers, look over a variety of potatoes or even consider substitutes, electricity is critical and its delivery must be anonymous and unconditional – power is transmitted to a pool/grid that everybody draws from. Electrons are electrons are electrons.

Like other energy commodities, consumption is independent of price. We flick switches, cook dinner, warm our homes whenever we need. System operators such as AESO rely on forecasting techniques to predict demand to ensure the system is prepared to meet demand both in real-time, as well as short and long term well being of the system.

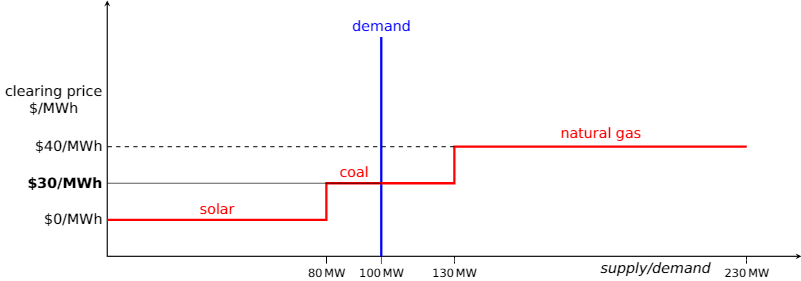

Let’s take an example. Let’s say we have a grid that has a total of 250MW of generation assets – 100MW of solar, 50MW of coal and 100MW of gas, and their respective asking prices are $0/MWh, $30/MWh and $40/MWh. Let’s say that the demand is 100MW and the solar farm is generating 80% of its capacity or 80MW. Based on the generators’ merit order, 80MW of solar and 20MW of coal will be dispatched. Because coal is the last generator to be dispatched, the market price will equal its bidding price of $30, which all cleared generators will receive.

Merit order with 100MW of demand, 80MW of solar and 20MW of coal

Although the solar generator is willing to dispatch power for as low as $0/MWh, they receive the clearing price of $30/MWh. The owners of the solar farm will generate revenue of (80MW x $30/MWh) $2400 for every hour the system is dispatched. The gas generator will be standing reserve because its asking price is higher than the clearing price. If demand were to grow by 20MW, the coal generator will increase its dispatch by 20MW to make up for it. If demand were to increase beyond 130MW the gas generator will fire up and the clearing price will be $40/MWh, and then all three generators will receive $40/MWh.

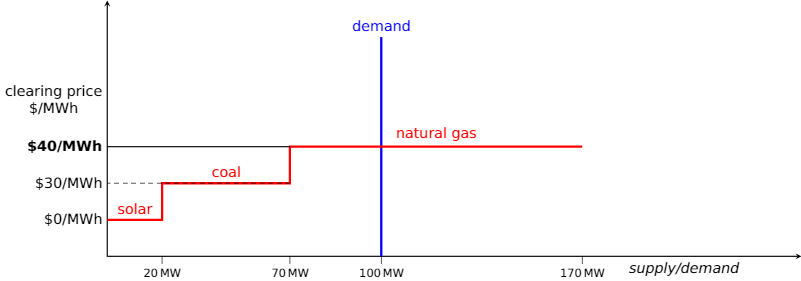

Let’s suppose it’s getting darker and the solar farm is only putting out 20MW but demand is still at 100MW. The supply curve will be shorter because the solar farm is generating less power. The dispatchable coal and gas generators will now have to increase their output by 80MW. As can be seen below this causes the market price to increase to signal to the natural gas generator to dispatch their power. Although the solar generator is supplying less power, they are receiving it at a higher rate because the clearing price is higher – same goes for the coal power plant.

Merit order with 100MW of demand, 80MW of solar and 20MW of coal. Clearing price is now $40/MWh

How does solar affect a deregulated power market?

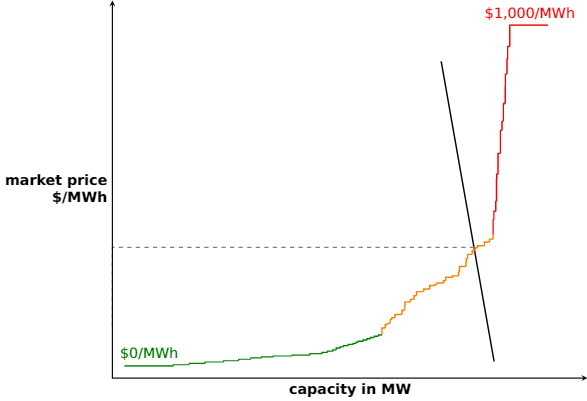

As we saw above, renewable generation facilities are always dispatched because of their low marginal costs and they will accept whatever the market price is, hence they’re sometimes referred to as price takers. However as solar and wind capacities increase so does their synchronized impact on the clearing price. For example, in Alberta we sometimes notice how times of high wind can cause the price of power to drop. Wind generators are starting to act more and more like price setters. Large utility generators such as Calgary’s Shepard combined cycle natural gas plant also behave as price setter because of the considerable space they occupy on the left side of the curve. If you go to ets.aeso.ca to monitor the grid’s load and clearing price, you can sometimes see how an expected shutdown of a large dispatched generator can cause the price of power to spike. In Alberta, the clearing price can be as high as $999.99/MWh, and as low as $0/MWh.

Example of a merit order showing different marginal costs

From energy-only market to energy and capacity markets

The Alberta power market has been in the news for the past couple of months as the province gears up for its plans to phase out coal by 2030 with renewables and natural gas. Some called into question whether Alberta’s energy-only power market will be able to attract needed investments in generation given the historic low power prices. Generators have been enjoying relatively high prices in the past which seemed to be a sufficient signal to build more capacity, but now that there is a glut of electricity AESO has recommended to introduce capacity payments which means that on-top of the revenue made on selling energy, generators will also collect revenue for being available.